Navigating tax implications, understanding compliance requirements, and managing potential liabilities are essential when using crypto-loaded virtual cards in Turkey. As you engage in transactions, you might trigger capital gains taxes, complicating your financial landscape. Knowing how to report these activities accurately becomes crucial. What specific documentation will you need, and how can you ensure you’re meeting all regulations? These questions can shape your approach to cryptocurrency in Turkey.

Overview of Cryptocurrency in Turkey

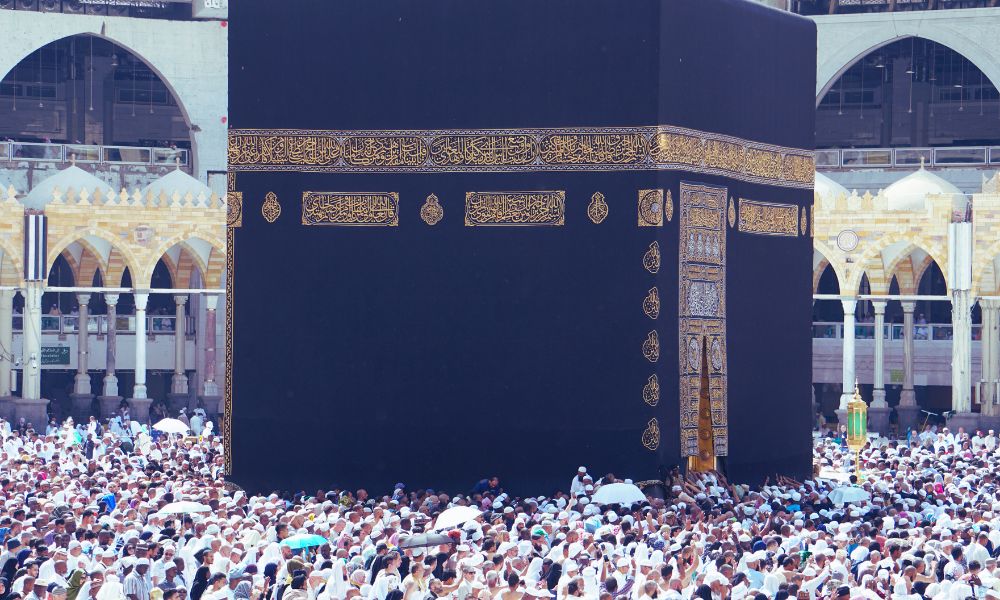

As cryptocurrency gains traction worldwide, Turkey has emerged as a significant player in the digital finance landscape. You’ll notice a marked increase in crypto adoption trends, driven by a young, tech-savvy population eager to explore innovative financial solutions.

The Turkish economy faces challenges like inflation, prompting citizens to seek alternative assets, and cryptocurrencies have become appealing. Blockchain technology’s impact is profound, facilitating transparent transactions and enhancing trust in financial systems.

Governmental interest in regulation hints at a maturing market, yet uncertainty remains. As you navigate this evolving landscape, understanding these dynamics can empower you to make informed decisions regarding your investments and participation in digital finance.

Embracing these changes may position you advantageously in Turkey’s burgeoning crypto ecosystem.

Understanding Crypto-Loaded Virtual Cards

Turkey’s increasing adoption of cryptocurrency has paved the way for innovative financial products, one of which is crypto-loaded virtual cards.

These cards allow you to spend your virtual currency seamlessly, offering numerous benefits like enhanced transaction speed and lower fees compared to traditional payment methods.

With a focus on crypto card security, these virtual cards often come with encryption and fraud protection measures to safeguard your transactions.

Additionally, they provide an easy way to manage your digital assets, enabling you to convert crypto to fiat instantly for daily purchases.

By understanding how these cards work, you can leverage their advantages while navigating the evolving financial landscape in Turkey.

Embracing crypto-loaded virtual cards could be a smart move for your financial strategy.

How Crypto Transactions Are Taxed in Turkey

While navigating the complex world of cryptocurrencies, it’s crucial to understand how tax regulations apply to your transactions in Turkey.

Crypto taxation challenges arise from the lack of clear guidelines, making it essential for you to stay informed about your responsibilities. Currently, the Turkish government treats cryptocurrencies as assets rather than currencies, which impacts how you report gains or losses.

When using crypto-loaded virtual cards, you enjoy advantages like enhanced security and convenience for transactions, but this doesn’t exempt you from tax obligations. You must accurately track your transactions, as failing to report can lead to penalties.

Understanding these nuances will help you navigate the intricate landscape of crypto taxation and ensure compliance with Turkish law.

Taxable Events Related to Cryptocurrency

When you engage in cryptocurrency transactions, it’s crucial to understand how taxable events like capital gains tax and income reporting obligations apply to you.

Each time you sell or exchange crypto, you may trigger a capital gains event that impacts your tax liability.

Additionally, any income earned from crypto activities must be reported accurately to comply with tax regulations.

Capital Gains Tax

Understanding capital gains tax is crucial for anyone dealing with cryptocurrencies in Turkey, as taxable events can arise from various transactions.

When you sell or exchange your crypto assets, any profit you make is considered capital gains and may be subject to tax. It’s essential to track your transactions accurately, as failure to report these gains can lead to penalties.

However, be aware that certain tax exemptions might apply, depending on the duration of your asset holding and the specific circumstances surrounding the transaction.

Engaging in proper record-keeping and consulting with a tax professional can help you navigate these complexities and minimize your tax liabilities effectively.

Make sure you’re informed to avoid unexpected tax burdens.

Income Reporting Obligations

As you engage with cryptocurrencies in Turkey, it’s vital to recognize your income reporting obligations, as various taxable events can arise from your activities.

When you convert your crypto into fiat or use it to make purchases, these transactions may generate taxable income. The Turkish tax authorities require you to report any gains, and failing to do so can lead to penalties.

Be mindful of the reporting thresholds established by the government; if your income from cryptocurrency exceeds these limits, you must report it.

Familiarize yourself with the specifics, as different forms of income and transactions, including staking or trading, can impact your tax responsibilities.

Staying compliant is essential to avoid complications down the line.

Reporting Requirements for Crypto Transactions

While navigating the landscape of crypto transactions in Turkey, you must be aware of the specific reporting requirements that apply.

Accurate crypto transaction documentation is crucial for compliance, as authorities expect detailed records of all your transactions. This includes dates, amounts, and the involved parties.

Utilize reporting software tools to streamline this process, ensuring your records are organized and easily accessible. These tools not only help in maintaining compliance but also facilitate the preparation of necessary reports for tax authorities.

Remember, failure to provide adequate documentation can result in fines or penalties. Stay informed about any updates to reporting regulations to avoid potential pitfalls in your crypto dealings.

Keeping thorough records will help you manage your obligations effectively.

Personal Income Tax and Cryptocurrency

Navigating the personal income tax implications of cryptocurrency in Turkey requires a clear understanding of how your crypto activities impact your tax obligations.

To effectively manage your digital assets, consider the following:

- Identify Your Income Sources: Distinguish between income from cryptocurrency investments and other sources.

- Track Transactions: Maintain meticulous records of all transactions for accurate reporting.

- Understand Tax Rates: Familiarize yourself with the applicable tax rates for different income types.

- Consult a Tax Professional: Seek advice from a tax expert to ensure compliance and optimize your digital asset management.

Capital Gains Tax on Crypto Transactions

When you engage in crypto transactions, understanding the capital gains tax implications is crucial for managing your tax liability in Turkey.

Any profits you realize from selling or trading cryptocurrencies are generally subject to capital gains tax. To optimize your tax position, consider various crypto investment strategies that may help minimize your taxable income.

For instance, holding assets for over a year could qualify you for capital gains exemptions, reducing your tax burden. Be aware of the specific regulations that apply to your situation, as tax rates may vary.

Keeping accurate records of your transactions will also aid in calculating your gains accurately, ensuring you comply with Turkish tax laws while maximizing your investment outcomes.

Value Added Tax (VAT) Implications

Understanding the capital gains tax on crypto transactions lays the groundwork for exploring another tax consideration: Value Added Tax (VAT).

In Turkey, using crypto-loaded virtual cards can trigger VAT implications you should be aware of. Here are key points to consider:

- VAT Exemptions: Certain transactions may qualify for VAT exemptions, particularly in the context of digital currencies.

- Taxable Events: Be mindful that using your virtual card for purchases may lead to VAT liabilities.

- Documentation: Keep accurate records of transactions to support your claims during a VAT audit.

- Compliance: Ensure adherence to Turkish VAT regulations to avoid penalties.

Navigating these VAT implications is crucial for your financial planning as a crypto user in Turkey.

Tax Deductions and Allowances for Crypto Users

Tax deductions and allowances can significantly impact your overall tax liability as a crypto user in Turkey. Understanding these elements is crucial for maximizing tax benefits related to your crypto investments.

For instance, you may qualify for deductions if you incur expenses directly linked to your crypto transactions, such as trading fees or costs associated with maintaining a crypto wallet.

Additionally, if you donate cryptocurrency to charity, you might be able to claim deductions based on the fair market value at the time of donation.

Always keep thorough records of your transactions and expenses, as they’ll support your claims for deductions.

Regulatory Framework Surrounding Cryptocurrency

As the cryptocurrency landscape evolves, Turkey has established a regulatory framework that seeks to address the challenges and opportunities presented by digital assets.

You’ll find that the country’s cryptocurrency laws focus on several key areas:

- Licensing Requirements: Exchanges must obtain licenses to operate legally.

- Consumer Protection: Regulations aim to safeguard users from fraud and scams.

- Tax Obligations: Clear guidelines dictate how crypto transactions are taxed.

- Anti-Money Laundering: Stricter measures are in place to prevent illicit activities.

These regulations, however, introduce regulatory challenges that can complicate compliance for businesses and users alike.

Understanding these laws is crucial for navigating Turkey’s evolving regulatory landscape effectively.

Penalties for Non-Compliance With Tax Regulations

Failing to comply with tax regulations in Turkey can lead to significant penalties that might impact both individuals and businesses involved in cryptocurrency transactions.

You’ll encounter several penalty types, including monetary fines, interest on unpaid taxes, and even criminal charges in severe cases. The Turkish tax authority prioritizes compliance, so non-compliance consequences can escalate quickly.

For instance, if you fail to report your crypto-related earnings, you may face hefty fines that compound over time. Additionally, repeated offenses could result in stricter scrutiny of your financial activities and potential legal action.

Understanding these penalties is crucial to avoid dire repercussions that can affect your financial standing and reputation in the long run. Stay informed to protect yourself against these risks.

Best Practices for Tax Compliance

When navigating the complexities of cryptocurrency transactions in Turkey, adhering to best practices for tax compliance is essential to safeguard your financial interests.

Implementing effective tax strategies is vital, and here are some compliance tips to consider:

- Keep Detailed Records: Document every transaction, including dates, amounts, and counterparties.

- Stay Informed: Regularly update yourself on Turkey’s evolving cryptocurrency regulations and tax obligations.

- Consult Professionals: Engage with tax advisors or accountants who specialize in cryptocurrency for tailored advice.

- Report Accurately: Ensure you report your crypto income and gains accurately on your tax returns to avoid potential penalties.

Future Trends in Cryptocurrency Regulation in Turkey

As you consider the future of cryptocurrency regulation in Turkey, it’s crucial to monitor the evolving regulatory framework and its implications for taxation policies.

Authorities are likely to introduce measures that not only enhance compliance but also adapt to the dynamic nature of digital currencies.

Keeping an eye on these developments will help you navigate the changing landscape effectively.

Regulatory Framework Evolution

While the landscape of cryptocurrency regulation in Turkey has evolved rapidly, it’s essential to anticipate future trends that could shape this dynamic environment.

As you navigate this regulatory framework, consider the following potential developments in crypto regulations:

- Increased Transparency: Expect clearer guidelines for crypto transactions to enhance compliance.

- Stricter AML/KYC Protocols: Legislative changes may introduce tighter anti-money laundering and know-your-customer regulations.

- Digital Asset Classification: Future frameworks might classify cryptocurrencies and tokens more distinctly, impacting taxation and usage.

- Central Bank Digital Currency (CBDC): Turkey may explore a state-backed digital currency, influencing the overall crypto market.

Staying informed about these trends will be crucial for adapting your strategies in this evolving regulatory landscape.

Taxation Policy Developments

Given the rapid growth of cryptocurrency in Turkey, you can expect significant shifts in taxation policy that will likely reshape how virtual assets are treated.

As regulators aim to strike a balance between encouraging innovation and ensuring compliance, you might see the introduction of tax incentives designed to attract investment in the crypto space.

These incentives could foster a more favorable environment for businesses and individuals using crypto-loaded virtual cards.

However, the policy impacts of these changes will depend on how effectively the government implements regulations.

Staying informed on these developments is essential, as they’ll influence your financial decisions and strategies related to cryptocurrency usage in Turkey.

Adjusting to new tax guidelines will be crucial for navigating this evolving landscape.

Frequently Asked Questions

How Do I Convert Crypto to Fiat Without Tax Implications?

To convert crypto to fiat without tax implications, explore tax-free exchanges that comply with crypto regulations. Always research local laws, as regulations can change, ensuring you stay informed and avoid unintended tax liabilities.

Are There Specific Tax Rates for Different Cryptocurrencies?

There are no universal tax rates for different cryptocurrencies; classifications can affect how you’re taxed. Your tax bracket implications depend on gains generated, so it’s crucial to understand each cryptocurrency’s treatment under your tax jurisdiction.

Can I Claim Losses From Crypto Transactions on My Taxes?

Wondering if you can offset your crypto losses? You can claim tax loss deductions on your crypto transactions, reducing your taxable income. Just ensure you document everything accurately for smooth filing and compliance.

What Records Should I Keep for Crypto Transactions?

You should maintain thorough transaction documentation for all crypto activities. This includes dates, amounts, wallet addresses, and any fees incurred. Proper record keeping will help you track your investments and simplify tax reporting later.

How Does Using a Virtual Card Impact My Tax Status?

Using a virtual card’s as impactful as a meteor strike on your tax status. It affects your tax residency and compliance with virtual card regulations, potentially leading to unexpected obligations you must navigate carefully.

Conclusion

Navigating the tax implications of using crypto-loaded virtual cards in Turkey can feel like traversing a minefield—one misstep and you might find yourself in a whirlwind of penalties! It’s crucial to stay informed and meticulous in your reporting to avoid any nasty surprises. By keeping detailed records and understanding your obligations, you can transform this potential burden into a manageable part of your financial strategy. Embrace the challenge, and you’ll conquer the complexities of crypto taxation with confidence!